Singh, Rav Pratap (2021) Constitution of tax: A tale of four constitutional amendments and consumption taxes. OakBridge Publishing, Haryana. ISBN 9789391032357

![[thumbnail of Singh2021.jpg]](http://pure.jgu.edu.in/26/1.hassmallThumbnailVersion/Singh2021.jpg)

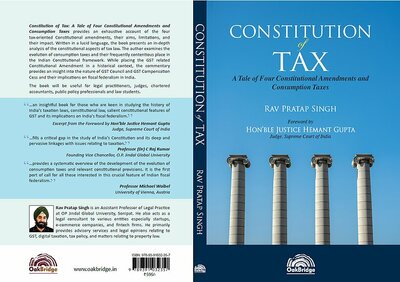

Singh2021.jpg - Cover Image

Download (113kB) | Preview

Abstract

Constitution of Tax: A Tale of Four Constitutional Amendments and Consumption Taxes provides an exhaustive account of the four tax-oriented Constitutional amendments, their aims, limitations, and their impact. Written in a lucid language, the book presents an in-depth analysis of the constitutional aspects of tax law. The author examines the evolution of consumption taxes and their frequently contentious place in the Indian Constitutional framework. While placing the GST related Constitutional Amendment in a historical context, the commentary provides an insight into the nature of GST Council and GST Compensation Cess and their implications on fiscal federalism in India. The book will be useful for legal practitioners, judges, chartered accountants, public policy professionals and law students.

| Item Type: | Book |

|---|---|

| Keywords: | Constitutional amendments | Consumption taxes | GST Council | GST Compensation Cess |

| Subjects: | Social Sciences and humanities > Social Sciences > Law and Legal Studies |

| JGU School/Centre: | Jindal Global Law School |

| Depositing User: | Admin Library |

| Date Deposited: | 16 Nov 2021 09:01 |

| Last Modified: | 17 Jun 2022 05:23 |

| URI: | https://pure.jgu.edu.in/id/eprint/26 |

Downloads

Downloads per month over past year

PlumX

PlumX PlumX

PlumX